Towards a new international monetary system - Part 2.

We first

established in January 2013 the need to resolve the problem of the

international monetary system, and its absolute priority. [1]

We then proposed in May 2013 a strategy to effectively prepare

the necessary resilience to support the change in the international monetary

system. [2] The various official announcements over the past months have

largely confirmed that this anticipation was shared. [3]

The synthesis of this strategy was again stressed by Laurence

Brahm on 21/10/2013:

" It is

not the complete removal of the old Bretton Woods financial architecture but

rather the creation of a new parallel structure to the old. Eventually,

countries will be able to choose which architecture is better suited to their

own plans for reconstruction and renovation. " [4]

This week of March 2014 where I release this article sees an

important step in international relations. It is nothing less than discussing

the 2015 framework and choosing between the repetition of the Vienna Conference

in 1815 (the Concert of Nations) or Yalta Conference in 1945 (the Cold War) that

will support the “new rules of the game in international politics“.

[5]

In fact, this week in Europe a large number of high level bilateral

meetings take place:

·

President Xi with the

Prime Minister of the Netherlands, François Hollande, Angela Merkel then with

the European Commission president [6]

·

President Obama with

President Xi, and then he has extended his trip at the last minute to meet the

Heads of State of the Netherlands, Italy, Belgium, UAE, South Korea, Japan, then

a meeting with the Pope in Rome and a meeting with the King of Saudi Arabia.

[7] Not to mention a planned meeting with Mr Barroso and Van Rompuy [8]

·

The G7 meeting on the

sidelines of the Nuclear Security Summit in 2014

·

And other bilateral

meetings, more or less official and prepared, among other heads of state following

their presence at the Nuclear Security Summit 2014.

Officially the goal is mostly to talk about the crisis in

Ukraine and Crimea, or to sign some contracts. The public communiques will

mention them.

We believe that other issues,

much more important but related, will be discussed : those around the current

reorganization of the new international monetary and financial system. [8.1]

Marketable U.S. Treasuries held by the Fed in custody for

Foreign Official and International Accounts; till 3/26/2014;

Our analysis is that the Ukrainian crisis was triggered by the

U.S. deep state in preparation for the introduction of this next reorganization.

[9] This is to retain the EU in the area of U.S. domination. [9.1]

The time has come to clarify what we mean by new international

monetary and financial system.

We believe this is not only about launching what is already

announced:

·

A Development Bank for

BRICS parallel to the World Bank

·

A BRICS stabilization fund

parallel to the IMF

·

New bilateral trade

agreements parallel to the WTO

but to go much further.

Firstly, BRICS Development Bank is becoming a "Bank

initiated by BRICS for the development of all interested parties" and

whose governance is open to any state wishing to join

with the framework agreement. [9.2]

Secondly, and this is the most innovative part: it is to create

another institution parallel to the Bank for International Settlements

(BIS).

This is the oldest international financial institution fully

governed by the West (6 permanent members and founders are the central banks of

Belgium, France, Germany, Italy, UK and USA, which can have a double voting

weight - analogy with Obama's meetings this week is not a coincidence

[10])

BIS is the central bank of central banks, that is to say, it

organizes and manage trade between them ... especially those concerning

physical gold. Activities related to financial regulation (the famous

Basel Committee rules) were added much later, after the existence of the bank

became public when it was kept secret since its inception. [10.7]

The first problem to solve for the overhaul of the international

monetary and financial system is not really the choice of a new currency. This

is only a means. This is primarily to ensure price stability and the

development of international trade. Otherwise, the only alternative is

endless war for resources that are increasingly scarce. It is therefore

necessary to separate the problem of a reference currency for international

trade, from that of a reserve currency for central banks.

Global geopolitical dislocation following the 2008 crisis has

cut the Gordian knot: there is no need any more to make a decision for all

countries (which has blocked reform for many years [10.6]). Now BRICS

countries have the initiative and willingness to move forward. This will

is the key factor as we wrote: [10.9]

The global

geopolitical context is characterized primarily by a tilt after reaching the tipping

point: the decline of the American empire on the one hand and the rise of the

multipolar initiative led by BRICS on the other. Because they are so

desperately lacking in autonomy of decision and willingness, the EU and Japan

find themselves buffeted by this tidal wave of history.

The choice is made for several years, international trade will

be based on gold [10.3].

How will this happen in practice? Not with boats or trucks

loaded with bullions, of course. As we said a "second BIS" was

designed that can manage a clearing house for payments (settlements)

in physical gold, especially to add to it a fundamental function to allow

again international settlements for goods using "Real Bills" (a.k.a. Gold

Bills), as recommended by the New

Austrian School of Economics. In his work Professor Fekete described these

Gold Bills as being “destined to be settled

in gold coins that are made available after

the ultimate consumer surrenders them in exchange for finished consumer

goods upon maturity”. [10.4] Their issue is strictly limited by the orders

received to buy goods. They allow increasing the money velocity without

systematically using coins and without any risk of inflation. [10.1]

This is far from a simple "100% gold" standard.

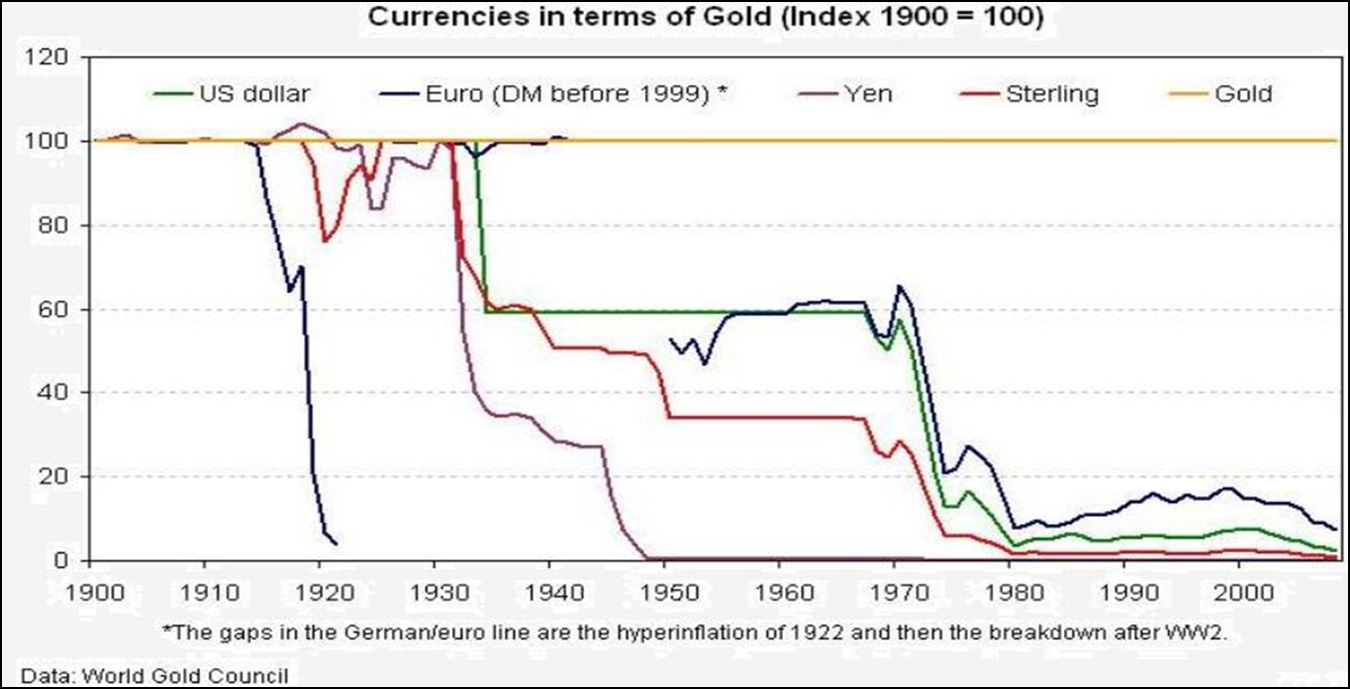

Gold is the only money (gold - silver ratio must float) as

everyone knew for millennia. Today most people have more or less forgotten

this unique role, but not Western central bankers who have tried for a century

to put lipstick on a pig, so to speak. [10.8] By deceiving us, they deceived

themselves and began to believe their own nonsense. A historical failure

and on a global scale. Alas, alas, it is a failure of the European

spirit. We need to recognize it in order to find the impetus beneath our

feet allowing us to arise from the depth of this graveyard by the sea.

[10.2]

BRICS countries do not necessarily need the West to initiate

this new settlement system. [10.5] It must be noted in this respect what it can supersede.

The dollar currency and U.S. Treasury at the foundation of famous

"petrodollars" are replaced by the Gold Bills that will allow buying

oil for example. [11] It is the function of reference currency for international

trade.

But US Treasuries have a function of income related to their mid/long

term interest rate too - it is also a fatal flaw in this system. This is

the second problem: the choice of the reserve currency for central banks.

The new system offers very smartly to decouple these two

functions. The income function can be brought (at appropriate time) by

introducing gold bonds, that is to say bonds denominated in gold weight,

with interests denominated in gold weight and whose principal is redeemable in

gold weight (ie not merely an obligation backed by a collateral gold and

denominated in fiat currency – a.k.a. gold backed bonds). Again,

we must have an institution for the issuance of these bonds.

Note that to start, it

is not necessary to replace any national currency by gold coins. The gold

bills will circulate in parallel of currencies, and user confidence in these

currencies will be reflected in real time in the local price of that currency

measured in mg of gold (that is to say, the inverse of the ‘price of gold’

measured in the currency, which is the usual vision that we have - a totally

wrong perception because you can not measure the length of a bar with a rubber-band:

you must take the opposite approach). Hence the fundamental importance of

not having rigged gold markets as currently in New York and London. [12]

Price of one U.S. dollar in mg of fine gold

between 1968 and 3/24/2014

The U.S. have no way to prevent BRICS countries to launch this

parallel system, a competitor of the one based on U.S. Treasury bond, and which finally obliterate their

attraction.

The only remaining choice as new rules for American decision-makers

(that is to say, the public state and the deep state) are the following, as they

are standing with their back to the wall [12.2]:

·

either to accept an open

cohabitation of two parallel

systems, with 100% of the players who know that the dollar system can not be

competitive (very quickly one system will endure and all U.S. Treasury assets going

up in smoke). Modestly this is called "asset restructuring in U.S.

bonds market." This is the path of Vienna in 1815. [12.1]

·

or not to accept this

open cohabitation, that is to say close the door to hide behind and build a

wall as high as possible so that no one can escape from the dollar

zone. For this area can last as long as possible (while being doomed

because of deflation), it must be the largest possible, and the EU is a

tempting (with its remaining gold reserves) and very easy prey thanks to

Atlantist governments and European Commission who are obediently following the

interests of the American deep state. The strategy is therefore to make

them sign the TTIP as soon as possible, which quickly convince them not

repatriate their gold and abandon the euro (two currencies for the US-EU area only,

is one too many) as they have already abandoned their sovereignty. This is

the way of Yalta in 1945. [12.3]

The next time you meet

your President or Prime Minister, you now know which good question to ask him:

what did he choose for us and that is supposed to commit all?

BRICS countries are reaching out to European peoples since 2009, and our

governments show their disdain so far, preferring the shadows of the world

before. [13] But it is not too late to think about our place in Europe and in

the world, it remains few short months and the ticket can be taken since this

week. Hurry up or repent.

What is currently

discussed off-line is however everybody's concern, and will commit us for a

long time to come. Do not suffer without understanding.

An error doesn't become a mistake until you

refuse to correct it.

(O.A. Battista, 1917-1995)

_______________________

[1] ‘La crise écologique globale exige une refonte du système monétaire international’,

Conscience Sociale, 01/2013 ; This article was itself in the continuity of the fundamental question raised in 2011: 'How to replace the world trade reference currency',

Conscience Sociale, 06/2011

[2] a) 'Towards a new international monetary system - part 1',

EN or

FR version, Conscience Sociale, 2013 ; b) The first mention of this strategy can be found in the conclusion of 'La géoéconomie des Bons du Trésor US',

Conscience Sociale , 12/2012

[3] a) ‘China, Europe Agree on Currency Deal’,

TheTrumpet.com ; b) ‘China's planned crude oil futures may be priced in yuan’,

Reuters ; c) ‘India to resume paying Iran in Euros’,

India Times ; d) ‘PBOC Says No Longer in China’s Interest to Increase Reserves’,

Bloomberg ; e) ‘China’s central government has reportedly approved 12 new free trade zones, including ones in Tianjin and Guangdong’,

The Diplomat ; f) ‘Harbinger: 23 countries begin setting up swap lines to bypass dollar’,

The Examiner ; g) ‘FMI: La réforme de l'institution reste bloquée par Washington’,

Les Echos ; h) ‘Dollar-based system is inherently unstable - The culprit is the dollar’,

Financial Times ; i) ‘A Shanghaï, Pékin s'offre un laboratoire des réformes’,

Le Monde ; j) ‘La banque de développement et le FMI des BRICS sont nés’,

L’Express ; k) ‘Shanghai Free-trade Zone to lead on yuan reform’,

South China Morning Post ; l) ‘IMF Quota and Governance Reform: Political Impulse Needed for Progress on Reform Process’,

CIGI ; m) ‘South Korea, Australia ink US$ 4.5 billion currency swap agreement’,

Sovereign Wealth Fund Institute ; n) ‘BRICS Bank: Caution is a good policy’,

India&Russia Report ; o) ‘G20 regrets IMF reforms delay, India says can't wait for long’,

Industan Times ; p) ‘Медведев: особую экономическую зону в Крыму будет курировать Козак’,

RBC Daily ; q) ‘Gold trading to open up to foreigners in Shanghai’,

SCMP, 03/2014; r) 'Russia without dollar - what are the risks?',

pravda.ru, 03/2014

[4] a) 'Les Brics veulent en finir avec l’extrémisme des marchés financiers’,

RIA Novosti ; b) original article: 'БРИКС положит конец рыночному фундаментализму'

RBC Daily

[5] a) R. Cohen, ‘International Politics: The Rules of the Game’, Longman Group United Kingdom, 1982 ; b) China's President Xi hence said this week: "China is firmly committed to ... building a new model of major country relations",

Reuters, 03/2014

[8.1] For instance we should not ignore: a) 'Did Russia Just Move Its Treasury Holdings Offshore?',

WSJ, 03/2014 ; b) 'Emerging Markets central banks sell US government bonds',

Financial Times, 03/2014

[9] a) ‘La crise ukrainienne, un événement de la politique profonde’,

Conscience Sociale, 03/2014; b) For the exact definition of

deep state see 'La politique profonde et l’Etat profond (deep deep politics and the State),

Conscience Sociale, 03/2014

[9.2] 'The Way Forward for the Brics New Development Bank ',

All Africa , 03/2014

[10] Obama and Cameron prepared this meeting last week:

whitehouse.gov , 03/2014

[10.1] Real Bills maturity is 91 days maximum.

[10.3] 'Building a strong economic and financial security barrier for China - Actively build and implement national gold strategies',

In Gold We Trust, 09/2013

[10.4] a) For more details, you can read his recent announcement ‘Gold Bills Payable in Gold Sovereigns'

AE Fekete, 03/2014 ; b) On the distinction between Gold Bills and Real Bills: ‘

Interview with Prof. Fekete’, Daily Bell, 03/2014

[10.5] The group formed by the BRICS is already sufficiently autonomous: 'Sanctions effect: Russia to change its Economic Partners... for the better',

Russia Today , 03/2014

[10.6] 'U.S. Dollar, Euro, Renminbi as invoicing currencies in international trade and as reserve currencies - A bibliography',

Conscience Sociale

[10.7] Founded in 1930, its existence was publicly unveiled in 1977. Note also that according to the by-laws the small territory of the BIS building is not subject to Swiss law. Police or army can not have access. See also 'Tower of Basel: The Shadowy History of the Secret That Runs the World Bank',

Adam LeBor , PublicAffairs, 2013

[10.8] 'Bernanke Tells Congress: I Don’t Really Understand Gold' ,

Forbes , 07/2013; But they recognized themselves be burnt out: see

Conscience Sociale, 08/2013

[10.9] 'Focus' chapter in Global Europe Anticipation Bulletin No. 83, 03/2014

[11] It should be noted in this respect that the BRICS countries have learn from the experience of purchases by India of Iranian oil using gold, through Turkish banks. This is a case of an unjust embargo imposed by the West proved to be a weakness that would lead to huge consequences. History is fond of this kind of irony. See a)

WSJ , 02/2014 ; b)

Foreign Policy , 02/2014

[12] a) 'Sun Zhaoxue: The United States Intends To Suppress Gold To Ensure The Dollar’s Dominance',

In Gold We Trust, 01/2014 ; b) The origin of this strategy date back to distant times. See for instance: 'Minutes of Secretary of State Kissinger’s Principals and Regionals Staff Meeting, Washington, April 25, 1974', in

FOREIGN RELATIONS OF THE UNITED STATES, 1973–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, DOCUMENT 63 ; c) 'La Manipulation du Prix de l’Or',

24hgold, 09/2008 ; d) 'Barclays, Deutsche Bank Accused of Gold Fix Manipulation',

Bloomberg, 03/2014

[12.2] 'L'implosion du marché COMEX et la dé-américanisation du monde’,

Conscience Sociale, 10/2013

[13] ‘La dérive néo-conservatrice de la politique française’,

Agile Democracy , 03/2014