You can click on each chart for a better rendering and zooming.

..: Updated Weekly :..

Shortcuts to: Remarks - TIC flows - Grand total & foreign holders - Custodial accounts - Fed 's holding - Foreign countries holdings

__________________________________

United States Treasury Foreign Holders

charts and data series

1. General Remarks

Note 1:

The biggest owner of U.S. Treasury in the world (*) is the U.S. Federal Reserve. Read figures, line "U.S. Treasury securities", at the extreme right of this page. Since December 2013, this amount is close to USD 2.2 trillion. See more details and charts on this page.

The evolution of US Treasury holding by the Fed has been discussed in details in this article: " La géoéconomie des Bons du Trésor U.S."

(*) We are counting here only known authentic U.S. Treasury bonds, and not of course the US$ trillions in "fake, counterfeited, bogus, fictitious, fraudulent" U.S. Treasury bonds. We have started to discuss this complex issue with the official lawsuit Keenan&Dragon family (plaintiff) vs US Federal Reserve.

Note 2:

The Social Security Trust Funds hold only special issues—securities sold only to the trust funds since 1984. They are therefore non marketable, and with a weighted maturity between 7 and 8 years. They are not Treasury bonds. BUT, as explained by Charles Hugh Smith in full details here, these securities cannot be redeemed directly for cash. They must be given back to the Treasury, which must previously issue for that purpose an adequate amount of new U.S. Treasury bonds in the global bond market to borrow the required money (or raise the money in new taxes or reduce spending... but look at the amount and don't bet for it). This means these SSTF securities are nothing but a kind of Special Purpose Vehicle for this part of the government debt, and actual sovereign promises to issue more Treasury bonds (and to borrow again for paying the debt and its interest to SSTF).

The assets of SSTF are described on a monthly basis here. As end of Jan. 2013, they represent USD 2.7 trillions. They represent also an equivalent amount of remaining-to-be-issued U.S. Treasury bonds... but who will buy them, except for the Fed ?

Note 3: Saving Bonds & Others investors

As end of December 2011, individuals, government-sponsored enterprises, brokers and dealers, bank personal trusts, estates, savings bonds, corporate and non-corporate businesses own U.S. Government Debt for a total of USD 1.102 trillion. Click here for browsing the total credit market instrument assets held by each of them (read the section: "Total credit market instruments assets and UST held").

Note 4:

New data series reflect new benchmark survey taken since June 2011, as described in the 02/29/2012 press release :

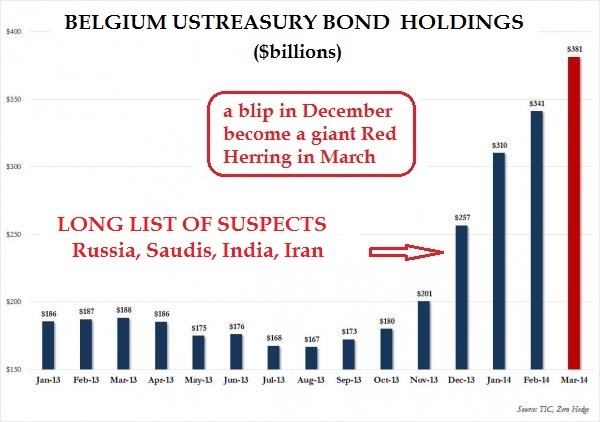

"It should be noted that in many cases it is not possible to accurately determine the country of residence of the beneficial owner of U.S. securities. Securities are often held in custody in countries other than the beneficial owner's country of residence. Respondents on this survey, in turn, may only know where the securities are held in custody. Thus, excessive foreign holdings may be attributed to countries that are major custodial centers, such as the United Kingdom, Switzerland, Belgium [EuroClear], and Luxembourg [ClearStream]."

"This revised table is based on the June 2011 survey data, but also includes new data on holdings of Treasury bonds and notes at the end of September 2011 and December 2011.[...] This inclusion of new data in the Major Foreign Holders table differs from past practice, where the Major Foreign Holders table was constructed based upon the June survey data and subsequently included monthly transactions data on foreign net purchases of long-term Treasuries until the next survey data were available.

As of January of 2012, the new data on foreign holdings of Treasury securities is being collected monthly instead of quarterly and will be included in the Major Foreign Holders tables in the future. This new data will improve the accuracy of country attribution for foreign holdings of Treasury securities by reducing the "transactions bias" from the transactions data that was included in past Major Foreign Holders tables."

Note 5:

- FAQ on the TIC data on Major Foreign Holders of U.S. Treasury Securities and Foreign Official holdings by FRBNY.

- Foreign Official Institutions’ Holdings of U.S.-issued and/or Dollar-denominated Financial Assets – Differences among Alternative Data Sources : pdf1, pdf2 (published in 2004).

2. TIC Flows

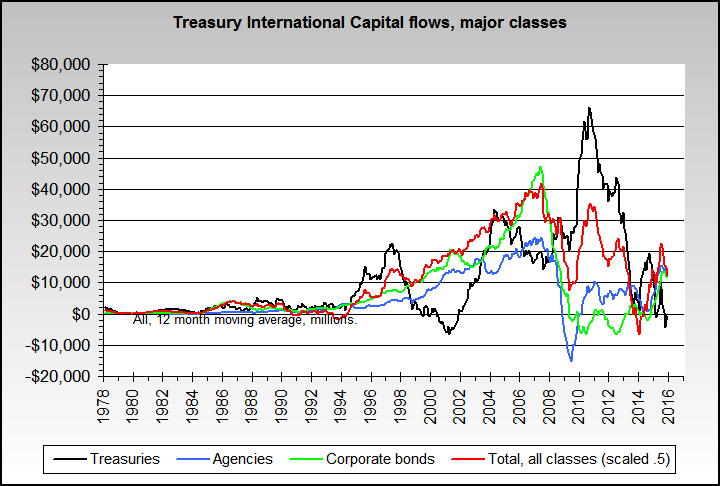

Treasury International Capital (TIC) flows, by major classes

The reference data for the last 3 months (with 2 months lag) are available from Treasury Department. Updated monthly the first working day after the 15th.

Others charts about US Treasury holdings are available on the U.S. Debt dashboard page.

3. Grand Total: Foreign Holders

Updated monthly with 2 months lag. This amount includes U.S. Treasury marketable and nonmarketable securities, held in custody or not, by any foreign country. It is slightly higher than FDHBFIN below (which is updated quarterly).

It is the sum of all countries & international investors holdings (hedge funds and foreign officials), as detailed in the last section of this page.

Source: Bianco Research

Updated monthly with 2 months lag. This amount includes U.S. Treasury marketable and nonmarketable securities, held in custody or not, by any foreign official.

A foreign official institution for TIC is defined as: Treasury of the states, including ministries of finance or corresponding departments of national governments, central banks, stabilization funds, including official exchange control offices or other governmental exchange authorities, and fiscal agents of national governments which have as an important part of their functions, activities similar to those of a treasury, central bank or stabilization fund. This also includes international authorities such as the BIS and the ECB.

This amount is included in the Grand Total discussed above.

This amount is included in the Grand Total discussed above.

This amount includes U.S. Treasury securities, Agencies, and for a very small part others marketable and non-marketable securities, held in custody or not.

At the end of 2011, 45 % of U.S. Treasury bonds were owned by foreigners (note that the % of total Federal Debt held by foreign investors was 33%), while the comparable figure for U.K. Gilts was 32 %. Foreign Japanese government bond (JGB) holdings were 9.1 % at the end of September 2012. (Source)

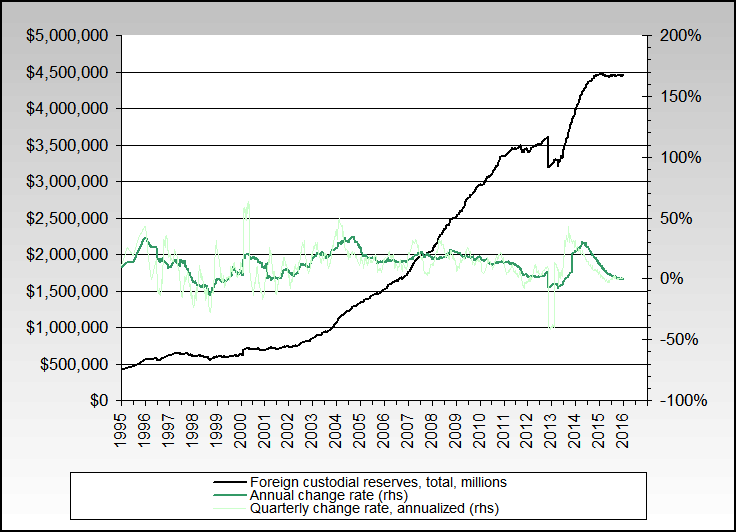

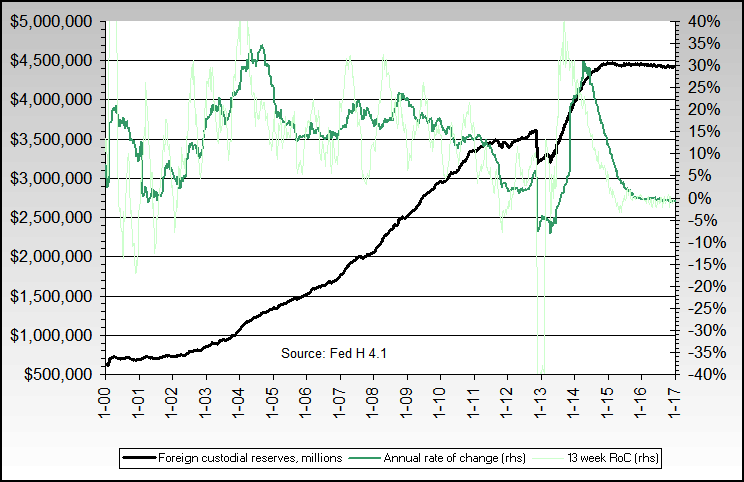

4. Custodial Accounts

This "total" includes U.S. Treasury and the Federal Agency securities, as described below. For an explanation of the difference between these FRBNY data series and the previous TIC ones, read the methodology.

Marketable securities consist of bills, notes, bonds, and TIPS. Non-marketable securities consist of Domestic, Foreign, REA, SLGS, US Savings, GAS and Other. Marketable securities are negotiable and transferable and may be sold on the secondary market.

Marketable securities consist of bills, notes, bonds, and TIPS. Non-marketable securities consist of Domestic, Foreign, REA, SLGS, US Savings, GAS and Other. Marketable securities are negotiable and transferable and may be sold on the secondary market.

Data series since 08/2007; Updated weekly on wednesday;

(Not the same definition than the discontinued serie)

Data serie from 1989 and discontinued since Nov. 2012

Note: WSEFINTL data serie was slightly lower than WSEFINT (both discontinued series since Nov. 2012).

Total of foreign custodial reserves;

Data serie since 1985 (USD millions); Updated monthly

Total of foreign custodial reserves;

Data serie since 2000 (USD millions); Updated weekly

The gap we can observe in december 2012 comes from the difference between the new data serie used and the discontinued one.

Source for these last 2 charts: nowandfutures.com, using Fed's published data.

The new WMTSECL1 data serie since 2007;

Updated weekly on wednesday; (Not the same definition than the discontinued serie)

Data serie from 1989 and discontinued since Nov. 2012, like WMTSECL

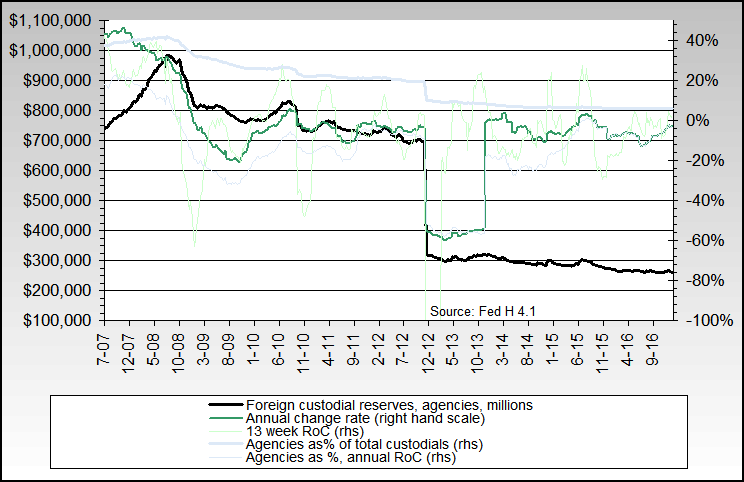

Data serie since 08/2007; Updated weekly;

(Not the same definition than the discontinued serie)

Data serie between 2000 and 11/2012; Updated weekly; Discontinued serie

Agencies in foreign custodial reserves;

Data serie since 2005 (USD millions); Updated weekly

The gap we can observe in december 2012 comes from the difference between the new data serie used and the discontinued one.

5. Fed's Holding of U.S. Treasury

- Fed's holding of UST (shares of the total notional amount; blue and red lines) and shares by foreign holders (green line) :

- Amount of U.S. Treasury securities held by the Federal Reserve: All Maturities, updated weekly :

- see more details about domestic and foreign UST investors, and their relative UST shares on this page.

6. U.S. Treasury Foreign Holdings: data series country by country

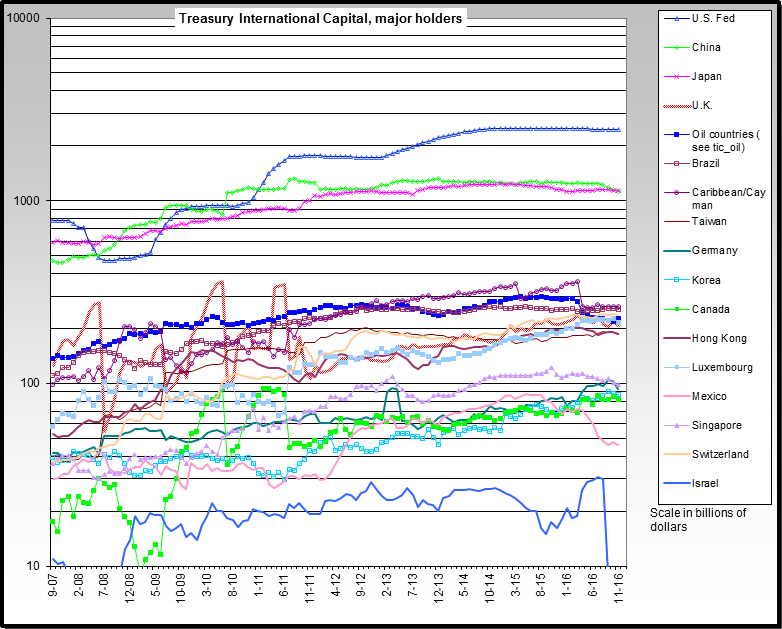

TIC, major holders; Data series since 06/2005; updated monthly;

source: Nowandfutures.com

- See also U.S. Long-Term Securities Held by Foreign Residents and by zone (last available month, last 7 months or last 7 monthly measures for each country - or csv file), for a breaking into Treasuries, Stocks, Agencies, Corporate bonds. Read also the FAQ.

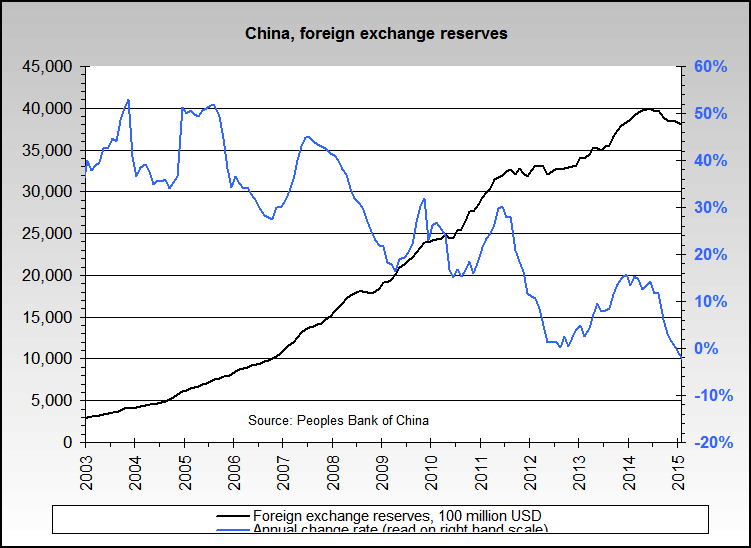

* Zoom on China holdings:

data serie 1990 - 3Q 2013; source

Data serie 2000-2009

Total of China Foreign Exchange Reserves; updated monthly

* Others UST holders:

The following 1Y moving data series were published monthly with 2 months lag, but the links to the charts from bloomberg.com are unavailable since 5 Sept 2012. The reference data are available from Treasury Department.

The following 1Y moving data series were published monthly with 2 months lag, but the links to the charts from bloomberg.com are unavailable since 5 Sept 2012. The reference data are available from Treasury Department.

China UST holding must be summed with :

and with : U.S. Treasury Foreign Holders: Hong-Kong

Oil exporters include Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia,the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria.

U.S. Treasury Foreign Holders: Russia

U.S. Treasury Foreign Holders: India

U.S. Treasury Foreign Holders: UK

United Kingdom includes Channel Islands and Isle of Man. Must be summed with :

U.S. Treasury Foreign Holders: Caribbean Banking Centers

Caribbean Banking Centers include Bahamas, Bermuda, Cayman Islands, Netherlands Antilles and Panama. Beginning with new series for June 2006, also includes British Virgin Islands.

Countries with companies specialized in holdings in custody:

U.S. Treasury Foreign Holders: Switzerland

and U.S. Treasury Foreign Holders: Luxembourg

Other EUROLAND Countries:

U.S. Treasury Foreign Holders: Ireland

U.S. Treasury Foreign Holders: France

U.S. Treasury Foreign Holders: Germany

U.S. Treasury Foreign Holders: Italy

U.S. Treasury Foreign Holders: Spain

U.S. Treasury Foreign Holders: Netherland

Other countries :

U.S. Treasury Foreign Holders: Canada

U.S. Treasury Foreign Holders: Poland

U.S. Treasury Foreign Holders: Israel

U.S. Treasury Foreign Holders: Sweden

U.S. Treasury Foreign Holders: Denmark

U.S. Treasury Foreign Holders: Colombia

U.S. Treasury Foreign Holders: Chile

U.S. Treasury Foreign Holders: Australia

U.S. Treasury Foreign Holders: Singapore

U.S. Treasury Foreign Holders: Norway

U.S. Treasury Foreign Holders: Thailand

U.S. Treasury Foreign Holders: South Korea

U.S. Treasury Foreign Holders: Philippines

U.S. Treasury Foreign Holders: Turkey

U.S. Treasury Foreign Holders: Mexico

Since 5 Sept 2012, Bloomberg stopped publishing updated graphs as jpg or flash files for most of the indicators followed here. The URL above only link to 1 year history graphs (snapshots).

RépondreSupprimer