Firstly about the Western coup against gold in 1971 :

Dr. Kissinger said that one answer to the question asked this morning was this. When the basic proposition is approved will we be prepared to defend the dollar? His impression was yes and that this was the purpose of the new exchange parities.

President Pompidou said he knew that the President expected him to speak frankly and he would do so. It was not so much for the French at the present time a question of the price of gold. There had been much talk about this. There was the Rueff theory that the price of gold should be doubled. This was not the question at present. For the present we should consider the general interest as between proponents of a liberal economy. That is, the Western World plus Japan.

[...]

President Pompidou said that we must not fear words. There was no question of the dollar becoming convertible into gold but if there is a consolidation of U. S. balances and the U.S. defends the dollar. Then the dollar is convertible from currency to currency. He understood the President’s reservation on an immediate statement but that is what it means or then there would be no real defense of the dollar. Dr. Kissinger said that we would have to buy dollars with other currencies in order to defend it. President Pompidou replied that this was correct. There was no other defense. Dr. Kissinger said that gold was out and President Pompidou said he understood this.

Excerpt from the minutes of the meeting between Pompidou, Kissinger and Nixon on December 13, 1971 at 4 PM, Azores.

Simply said, the post-Bretton Woods regime and the demise of gold in the International Monetary System was accepted only in the name of the defense of the Western World, that is, of bank owner's interests.

It is significant that this ambition is not shared anymore between the Western leaders, or said differently: the official come-back of gold in the IMS will be at the same time a proof that the Western World's domination by its previous so-called elites does not exist any more, or at least is surrendering.

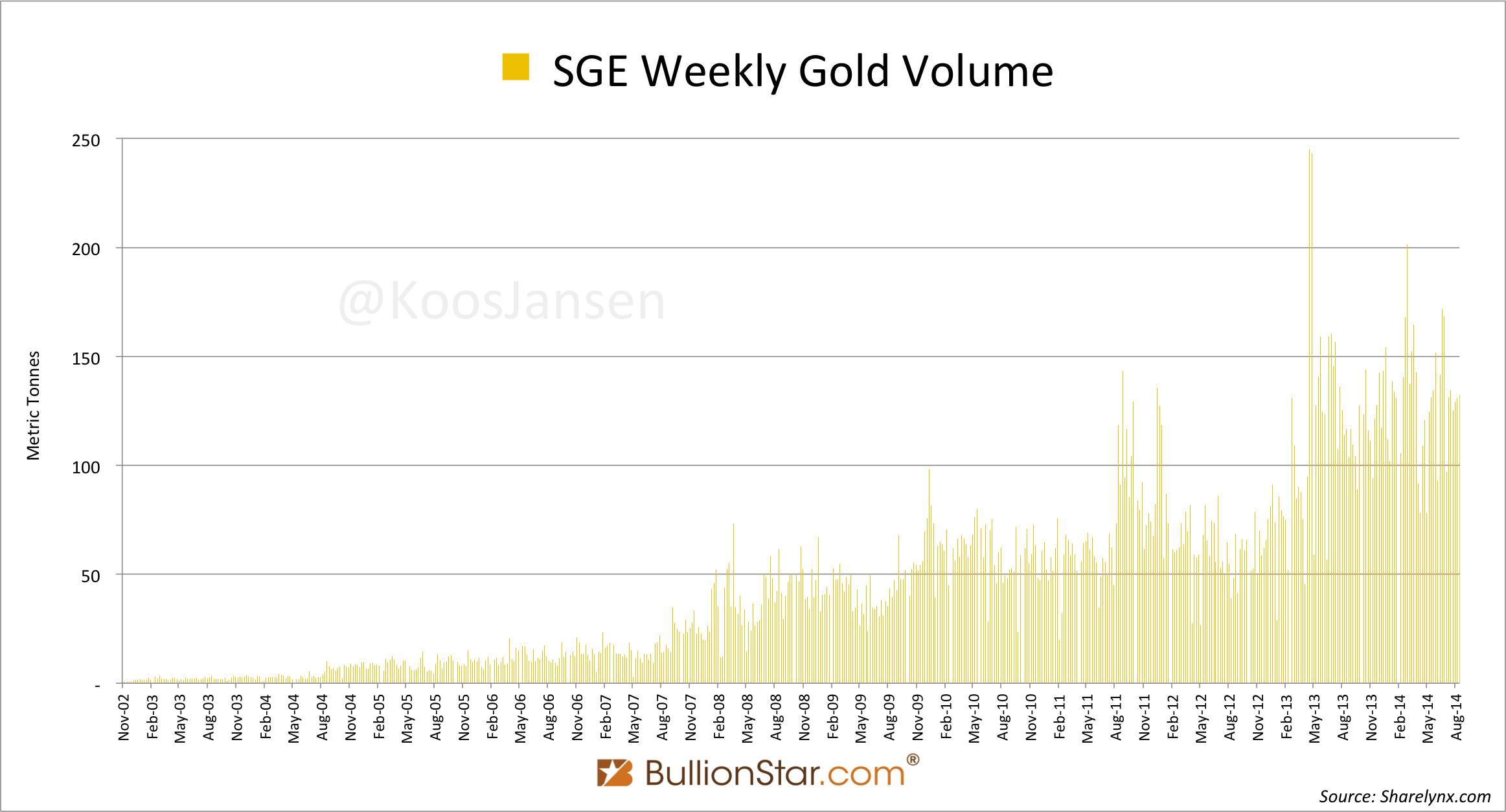

An secondly: 44 years after the Azores meeting, Xu Luode presents the SGE’s international ambitions in the Indian Bullion Bulletin, volume 5, issue 2, Feb. 2015, pp. 34-36. He is the chairman of the Shanghai Gold Exchange (SGE), Vice Chairman of China Gold Association, Vice Chairman of China Payment and Settlement Association, and the Executive Member of China Finance Society :

The International Board lends greater weight to the importance of Asian gold market on the international stage. China, India, Dubai and Singapore all enjoy vibrant trading scenes and comparative advantages; however, in the eyes of many investors, the influence wielded by the Asian markets is still very limited as a whole. Using the International Board as a launch pad, China’s gold market will embrace greater openness and foster stronger ties with its neighbors and, together, elevate the trading and pricing influence of Asia in the world’s gold market.

[...] SGE and [US-based] CME have recently signed a Memorandum of Understanding with regards to future cooperation efforts. As a perennial major consumer of gold and a close neighbor of China, India will undoubtedly become one of SGE’s most important partners in the coming years. SGE looks forward to forming close partnerships with the Indian market.

[...] Furthermore, the SGE will focus on enhancing its transit and leasing businesses, gradually roll out foreign currency-based collateral services and FX swaps, accept offshore funds from more varied sources for International Board transactions, further improve the financial services offered to international members and customers in regards to account opening and cross-border funds transfers.

The strategy for Shanghai Gold Exchange is very clear: to become the Global Exchange Center for monetary metals with affiliates, antennas (call them) in London, Tokyo, all Asia, BRICS main gold Exchanges (including NY with CME's MoU as a first step) in order to seek real market-based price synchronisation all over the world.

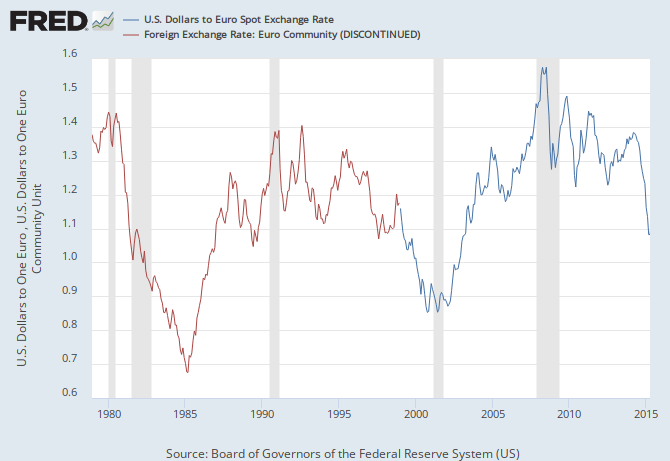

In short: between 1971 and 2015, gold was not really out of the IMS, Mr. Kissinger. It was simply pulled out from the West and it has flown to Asia. Now gold is ready to gradually emerge back as a basis of international monetary system.

%2Fa*100%2Ca%2Ca*0&fgst=lin%2Clin%2Clin&fq=Daily%2CDaily%2CDaily&fam=avg%2Cavg%2Cavg&vintage_date=%2C%2C&revision_date=%2C%2C)