[This is the English translation of the original article published in French.

Part 2 of this serie is available here: The golden age of our times is the age of gold]

Part 2 of this serie is available here: The golden age of our times is the age of gold]

Foreword:

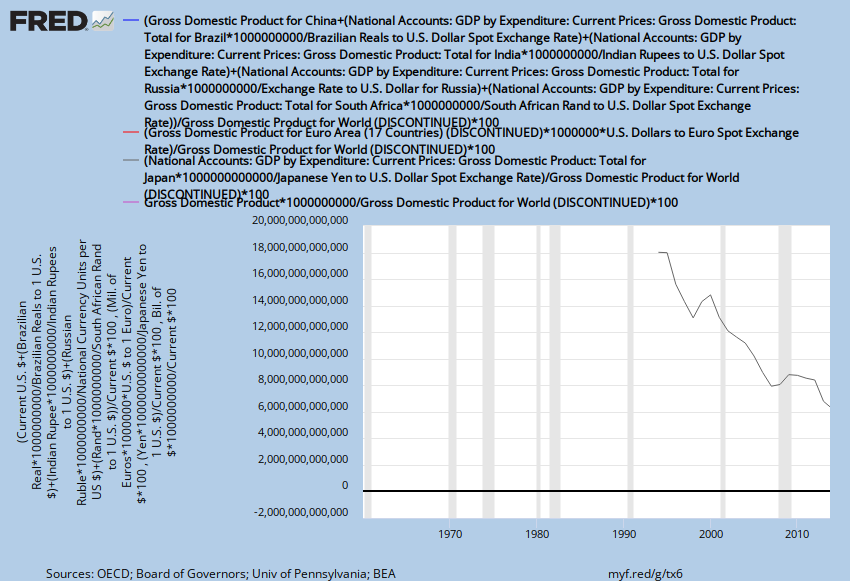

The crisis of legitimacy faced by the institutions of the global governance system set up after 1945 is resulting in the collapse of the old framework of international cooperation, with apparently nothing ready to replace it, besides a myriad of more or less successful regional integration projects. The supra-national regional entities that are currently being forged, created in a context of increasing emergency, are indeed the building blocks of tomorrow’s multipolar world. These integration processes are certainly a necessary step, but without a new "global" governance framework, capable of harmoniously combining these new components, conflicts of interest will soon oppose them and will quickly lead the world into the logic that prevailed in Europe in the late nineteenth century and the first half of the twentieth century.

Today everyone can see these tensions mounting between blocks on the themes of access to commodities, trade, currencies,.. putting high pressure on the fragile world peace and endangering the impressive development of emerging powers and the long period of prosperity of Western powers.

The next G20 to be held in Saint Petersburg in September is the next opportunity that the world gives itself to find solutions to the growing difficulties facing its equilibrium. But time is running out...

The Euro-BRICS strategic alliance :

For three years now and based on three seminars already, LEAP and MGIMO have been advocating a Euro-BRICS strategic alliance wishes to enable:

- Europe to turn more resolutely towards the future dynamics that the BRICS bring

- the BRICS to find the allies they need to achieve a more balanced global governance system.

In this double simultaneous development, the whole world has everything to gain.

The last seminar of the Euro-BRICS research network was held in Moscow on 23 and 24 May 2013 and addressed several major issues that the dynamics of Euro-BRICS relations could bring solutions upon, which include monetary and trade issues.

My presentation was titled "Towards a resilient international monetary system to systemic crises". I presented a strategic overview of the first part of my thoughts on the evolution of the international monetary system, which concerns the short-term. When reading its content (full text below) it may yet seem too much avant-garde or even wacky. This is not the case as demonstrated by recent announcements: first the announcement last July of the use of Qianhai special region for the purpose of innovation in financial flows. And second: in June 2013, the Asian Development Bank, the Centre for International Governance Innovation and the Hong Kong Institute for Monetary Research published a study entitled "A Practical Approach To International Monetary System Reform: Building Infrastructure For Settlement Regional Currencies" (originally presented in a conference December 2012 in Hong-Kong) and exactly aligned with the strategy that I have described.

Bruno Paul, 08/27/2013.

Towards a resilient international monetary system to systemic crises

Back in April 2010, the World Bank member countries agreed to change its severely criticized governance. This text has never been ratified by the U.S. Congress.

On 03/26/2013 the BRICS countries announced the opening in 2014 of their own development bank, a fund with more than 100 billion USD, which will be able to substitute to the World Bank when appropriate.

In response to the question I asked last 04/19/2013 at the conference #futureecon organized by the IMF, about the possibility of creating a second IMF by the BRICS countries, the IMF Deputy General Manager M. Min Zhu worried about this eventuality, and the question is no longer taboo. We need to remember that the world has witnessed the use of two simultaneously dominant reserve currencies during the interwar period. The U.S. dollar and British pound were used in almost equal parts, each with their own geographic area of influence.[5] To continue only to forecast a single international monetary system and a single reserve currency is therefore probably a reflex or an intellectual habit.

IMF has announced a commitment to a review of quotas by January 2014, a proposition championed by BRIC countries since 2008. [1]

From the conclusions of their last April and May meetings, G20-Finance, the World Bank, the IMF and the IFMC helped to highlight the strong convergence of international debate and a consensus on three key principles: structural reforms that will manage debt on a sustainable path, deficit reduction over the medium term and reduction of global macroeconomic imbalances. It is explicitly stated the need to restore the resilience of the international economic system.

The IFMC press release specifically indicates a commitment to refrain from competitive devaluations.[6]

We can then define two groups of countries: those who actually enroll in this consensus, and those for whom it is only words since the beginning of the crisis. Factual analysis of the evolution of macroeconomic indicators since 2008 allows us to isolate in one group: the U.S., Japan, and the United Kingdom, and in another group: all others G20 countries. For instance, efforts towards a fiscal convergence within the eurozone are particularly remarkable. The integrated economic government of Euroland, with a president appointed at its head who would be responsible for a tax harmonization among the member countries and to extend the plan against tax evasion is growing each day a little bit more, these days by the official voice of François Hollande who so wishes to occur before 2015.

On the other group, without having to officially using the terms of "competitive devaluation" the weapon of extraordinary monetary policies has already allowed the yen to lose continuously 25% of its value against the dollar, the euro, and the yuan since October 2012. Analysts announce the continuation of this trend throughout 2013.

Therefore

what struck us is the failure of the IMF strategic mission of financial

supervision, whose official statements endorse the practices of countries that

do not play the multilateral game.

This

has already pushed the BRICS countries to develop a common strategy for the reform

of the international monetary system. [4] To my mind it is shared by the political

leaders in the Euroland and fully in the logic of closer Euro-BRICS relations. Let’s list the the big milestones of

this multilateral strategy for the reform:

- Reform and entry into force of new quotas and voting rights in the IMF, with an improving weight for countries like the BRICS;

- Reform of the basket of currencies defining the SDR currency (with gold gram);

- Development of a very deep and liquid market for international trade based on the new SDR

- Slow rebalancing of global macroeconomic imbalances in the medium term, is to say 20 years minimum

The

unprecedented political movement created by the creation of a new BRICS development

bank, far from appearing as a simple duplication, can be also useful to

stimulate diplomatically the progress of this multilateral strategy.

The key

question then becomes, in my opinion: is the necessary delay to ensure the

success of this strategy allowed? As stated in the introduction of our

seminar: "time is running out." We recently published in the Magazine of

Political Anticipation an analysis of U.S. foreign and domestic policies going

back over a century, and we showed that the policy of military Keynesianism at

work in this country led to a strong erosion of democracy, today already at a

level where we can anticipate that a significant portion of U.S. citizens in a

few years will be forced to follow the path of an open struggle against their

federal government. To the international pressure will follow for the U.S.

government a rapidly growing domestic pressure.[7]

Moreover,

the unveiling role of the world systemic crisis has occurred:

- First,

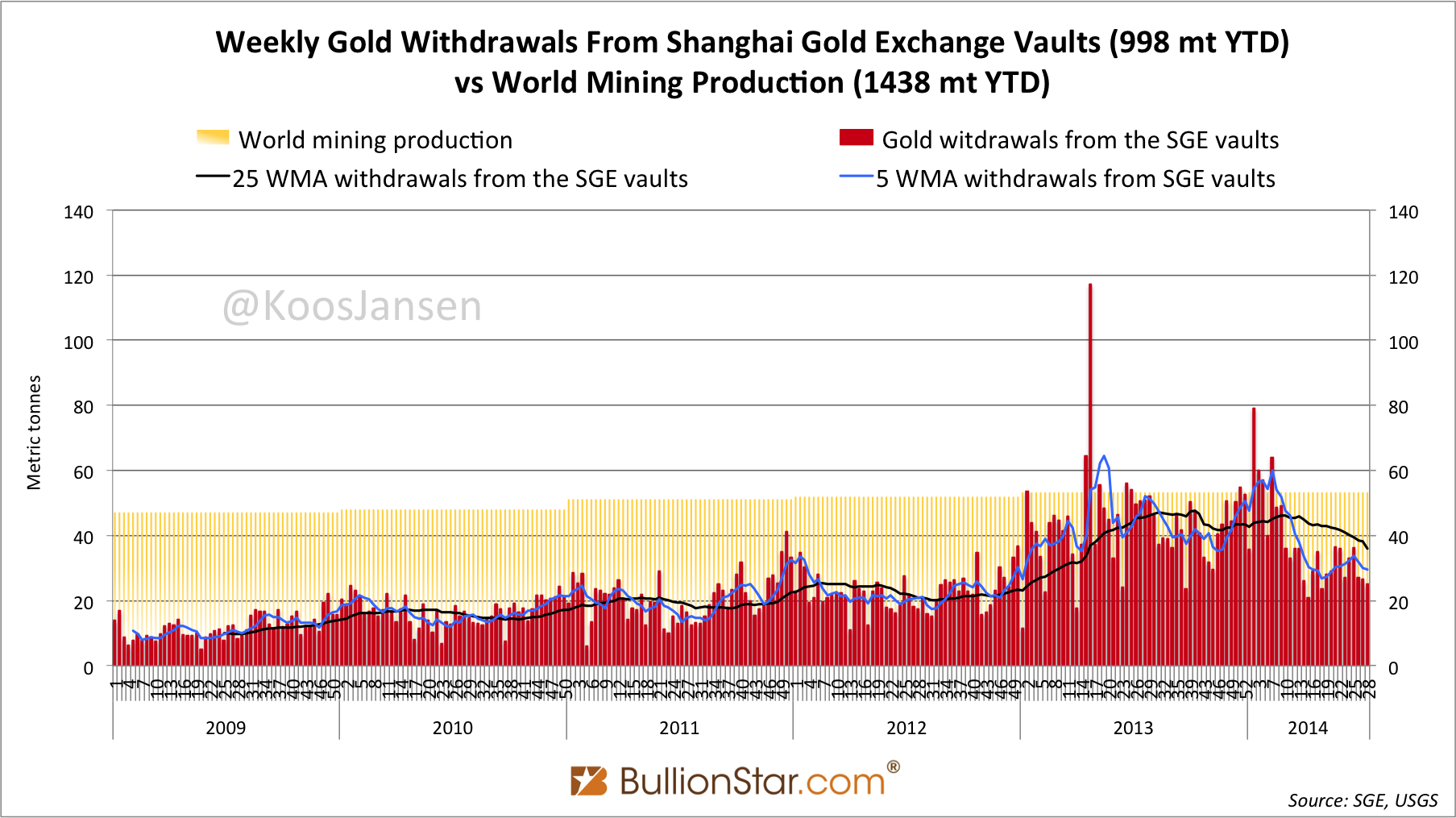

in the recent and anticipated dramatic shifts in the gold market which revealed

the price manipulation through short sales contracts on the COMEX in New York,

followed by withdrawal of almost all of the eligible physical gold

stocks stored by JPMorgan Chase , one of six bullion banks sharing the gold storage

and physical delivery for COMEX futures market.

In two

days, 400 t of gold disappeared from the bullion banks [3]. At the same time

appears the loss of correlation between the official quotation of gold (that is

to say, gold paper quotation) and the physical gold which is now accessible

only through the addition of a premium which greatly increased , and is highly dependent on local supply. And finally

we need to point out the historical record for physical gold imports by Asian countries in the first quarter,

including 300 t for China.

Source : ZeroHedge

-

Second, the disclosure is evident in the growing number of leaked lists of

thousands of owners of bank accounts in tax havens since 2007 (beginning with

the Lichtenstein then Switzerland [2]), in the investigations that the

States including those of the Anglo-Saxon pole are forced to conduct, and

finally in the growing regulation of automatic data exchanges from tax havens banks

to the fiscal administration in the state of residence.

These unveilings

are major factors accelerating the global systemic crisis, in its current

phase.

It

seems to me therefore essential not to abandon the multilateral strategy to

reform the international monetary system, but to quickly add to it another

initiative from the Euro-BRICS group. This second initiative draws on the

logic currently at work of global geopolitical dislocation, and I call it “Multipolar

Strategic Initiative for Resilience”. Its purpose is to minimize the effects

of currency war, and to complement the use of the many new bilateral swaps.

Our

proposition is to develop or create Special Administrative Regions for each

country of the Euro-BRICS group. These regions would be dedicated to

flows of goods traded by each country of the Euro-BRICS with the United States

and Japan, like the existing status for Hong Kong or Macau. The inclusion of the UK in this list of

special trade partners could be studied as well, but the process is made much

longer and uncertain for the euro zone because of the current European

treaties. Possible future voluntary exit from the European Union

by the UK would call for study its inclusion in this list.

Euro-BRICS

countries would not make any more invoicing or payments for goods selling directly

with the United States and Japan. Note that we consider for the moment only

flows of physical goods, that is to say, the greater part of the real economy. Import/export flows and re-invoicing would

be operated only using transhipment through the Special Administrative Regions

(SAR). The idea would be to use in these regions a different currency

than the one commonly used in Euro-BRICS countries, in the same way that the

Hong-Kong dollar is not the same currency than the yuan or renminbi. Current currencies would remain

convertible on the market. These Special Administrative Regions would concentrate

the risk of trading with countries with great variations in currency exchange

rates. Euro-BRICS countries would be able to regulate at will

the rate of exchange between their own currency and the one in force in their

own SAR. These SAR would be developed or created around major ports currently

used for trade with the USA and Japan. Registering not strictly necessary

financial activities (private funds ...) in these SAR will be discouraged.

Trade

between the Euro-BRICS countries should not be affected by the development of

the RAS, and if possible do not pass through them. These areas should be used only to build

a “firewall” (like when protecting IT networks) for trade with countries whose

observed policies have proven their unwillingness to respect the required governance

for an effective multilateral trade dialogue.

However,

it is desirable that the Euro-BRICS countries strengthen their abandonment of

the dollar as their international invoicing currency for trade between them,

including for oil products. The existing agreements should be amended accordingly.

The Multipolar

Strategic Initiative for Resilience is very flexible. Each country can progress at its own

pace in this direction, respecting the new cooperative logic of global

governance summarized by the expression of Evgenia Obitchkina: “the multipolarity

alongside the diversity." [8]

The

main advantage of such a "string of pearls" of RAS that would interface

with the United States and Japan, in addition to reducing the currency risk thanks

to the strict control of the exchange rate with the SAR and to the billing

terms that can be optimized, lies in the resilience of the international trade system

in case of default of major financial institutions in the United States or

Japan. For Euro-BRICS countries, financial defeasance structures (Special

Purpose Vehicles…) would be registered in the RAS and systemic risk would be more

contained without jeopardizing businesses and public debts of the Euro-BRICS

countries.

Finally

this initiative can be simply summarized: it is to organize and regulate the

interface between the dollar-yen area and the rest of the world. The trade and economic

size of the Euro-BRICS countries is sufficient to initiate the successful

containment of the systemic risk.

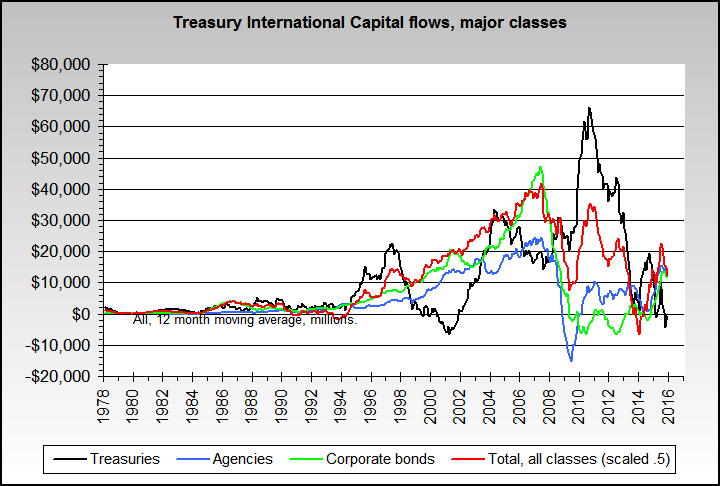

In a

second step, one could think about control of capital flows between the

Euro-BRICS countries and U.S. / Japan, but it seems to me less of a priority

and can be developed independently. The Asian crisis of 97 and the euro

crisis have already raised awareness of required significant exchange reserves

or alternative mechanism to dampen currency crises or sudden withdrawal of

capital by U.S. companies.

The

world of tomorrow, but also visible prospects out of the current global crisis

depends to a large extent on the qualities of the new international monetary

system and first its stability. The Multipolar Strategic Initiative for Resilience is

a new step towards a dual international monetary system resilient to global

systemic crises. As Deng Xiaoping stated: "One World, a dual

system" is the horizon to which we should move forward. And as said Richard Fuller, “to change something we need to build a new model

that makes the existing model obsolete”. The mere mention of this possibility is

already a carried weight argument to improve the effectiveness of the

multilateral strategy. This new initiative is a potential source of true

political influence for the Euro-BRICS and for a growing synergy by network

effect.

Bruno Paul, 05/23/2013, Moscow.

[1] Quotas Page, IMF; IMF fails to agree on new formula for vote reforms, Reuters, 01/2013; Reform of the IMF Executive Board, quotas: status update, SAFPI, 02/2013; Press release 10/418, IMF, 11/2010.

[2] Shortly after the agreement with the French fiscal administration is an agreement reached between UBS Switzerland and the USA .

[3] K. Weiner has since proposed a different explanation for this fact. It is seldom known and deserves to be mentioned.

[4] M. Otero-Iglesias, M. Zhang, EU-China Collaboration in the Reform of the International Monetary System, RCIF Working Paper No. 2012W07, 04/2012; Mr. Otero-Iglesias, China, the Euro and the Reform of the International Monetary System , 10/2012

[5] C. R. Schenk, The Retirement of Sterling as a Reserve Currency after 1945: Lessons for the US Dollar ?, Canadian Network for Economic History conference, 10/2009 ; B. Eichengreen, M. Flandreau, The rise and fall of the dollar, or when did the dollar replace sterling as the leading international currency?, NBER Working Paper 14154, 2008.

[6] Statement by Secretary Jacob J. Lew at the International Monetary Financial Committee (IMFC) Meeting, 04/2013.

[7] B. Paul, The inevitable counter-revolution of the American people, Magazine of Political Anticipation, n.8, 03/2013; See also the long version of this article in French.

[8] E. Obitchkina, « From the diplomacy of states to that of networks: powers and areas of interest », 3rd Euro-BRICS seminar, Cannes, 09/2012.