1- Mainstream economists (both Friedman's side and Keynes' side) are always very reluctant to confront their models and their past predictions with long term and updated data series.

Let's just have a look if they really won the match since 1960's :

- How close to an exponential trend is the growth of U.S. Total Public Debt :

- How close to an exponential trend is the growth of Federal Total Public Debt (In 2013 Q1, it reached US$ 16.8 Trillion) :

- Interest rates in US and UK :

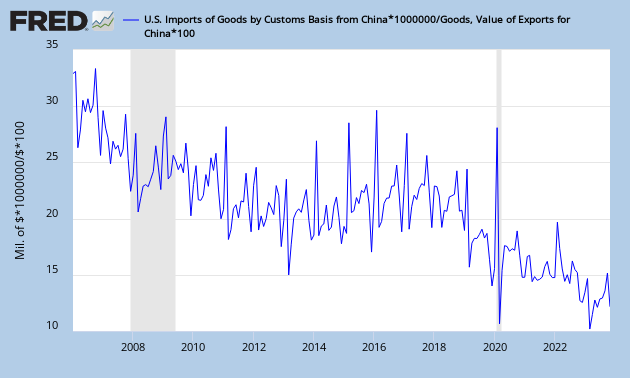

- U.S. Net Export of Goods and Services :

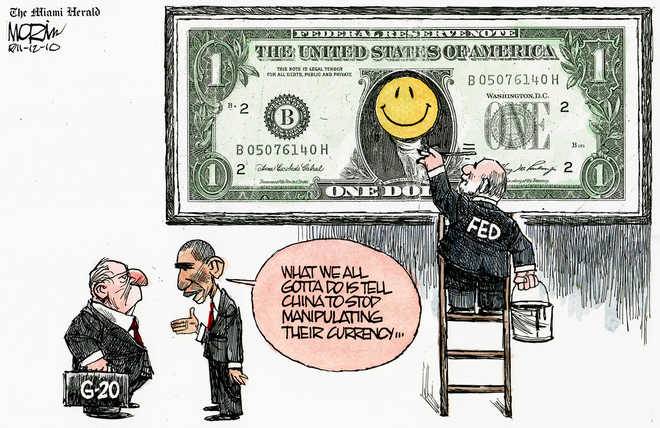

- Real Trade Weighted U.S. Dollar Index :

- Consumer Price Index :

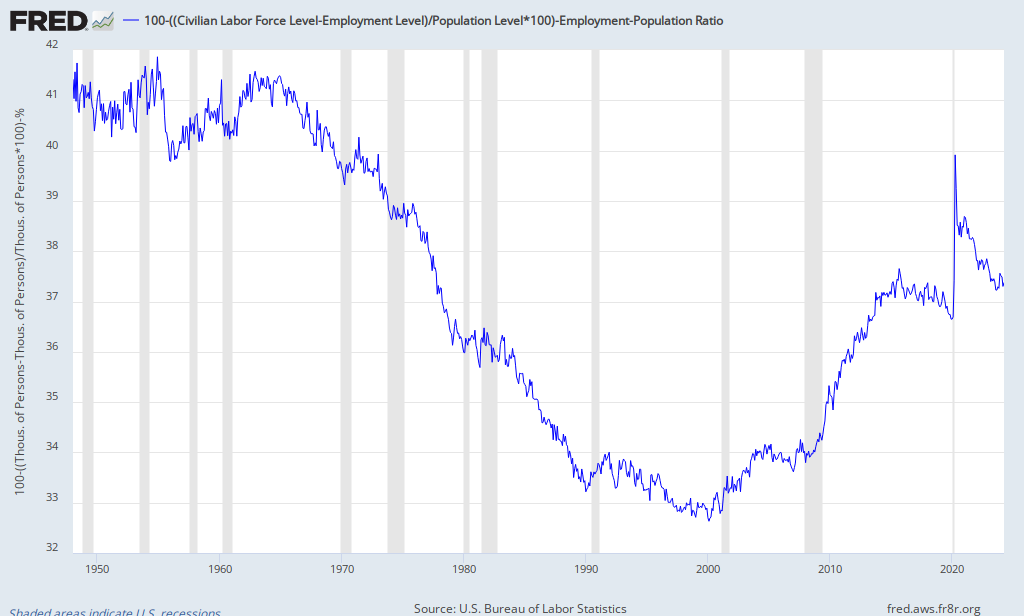

- "Civilian Unemployed and Not Looking Ratio" is the proportion of the civilian non institutionalized population aged 16+ that is unemployed and not looking for work :

- US Population receiving food stamps :

- Ratio of Corporate dividends over wages & salary :

- There are now more people under “correctional supervision” in America (more than six million) than were in the Gulag Archipelago under Stalin at its height :

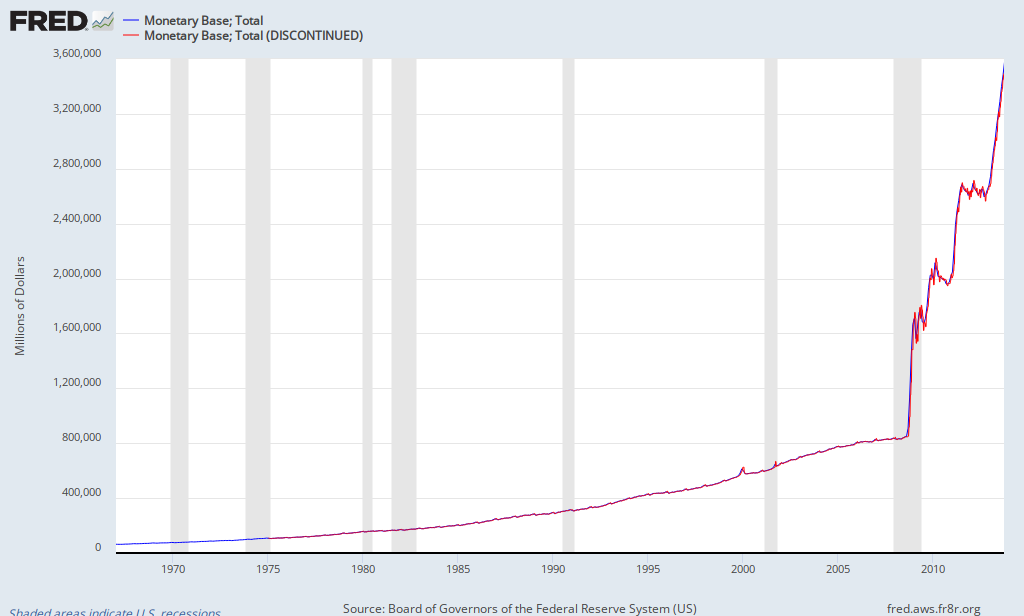

- US total monetary base priced in tonnes of Gold :

- 1 U.S. $ priced in mg of Gold :

- Annual U.S. and UK output produced (GDP per capita) priced in troy ounces of gold :

2- Observations:

* all mainstream commentators have analyzed the economical policy of the U.S. and UK to use neoliberals ("Chicago school") principles, and more Keynesian policies since 2008.

3- Then we can affirm :

But given the very low speed of reforms by EU academies, the lock by Swedish Central Bank from one side, and the current global shift of power from the other side, we can anticipate that BRICS will announce the creation of a new "Prize in Economics funded by a BRICS organisation" and elected by the BRICS academies, before any process reform for Nobel Memorial Prize in Economics takes place. This is an anticipated consequence of both the global geopolitical dislocation and the scientific crisis in economics.

We anticipate this announcement within 4 years at the latest, depending on the number of future laureates working in universities located in BRICS countries, or eventually from non mainstream school of economics (for instance A. Fekete from NewASoE but this award alone would finalize a paradigmatic change).

Updated 10/14/2013:

- including results of 2013 awards ;

- My congratulations to Shiller who is pursuing a good work using data and facts about the housing market., although I did not agree with his sale of the rights to build the Case-Shiller index to a private company.

- List of laureates in Economics

- Brief Statistics of the Nobel Prize Winners for Economics, IONECI M., ENE S., 2011; The period observed was 1969-2010.

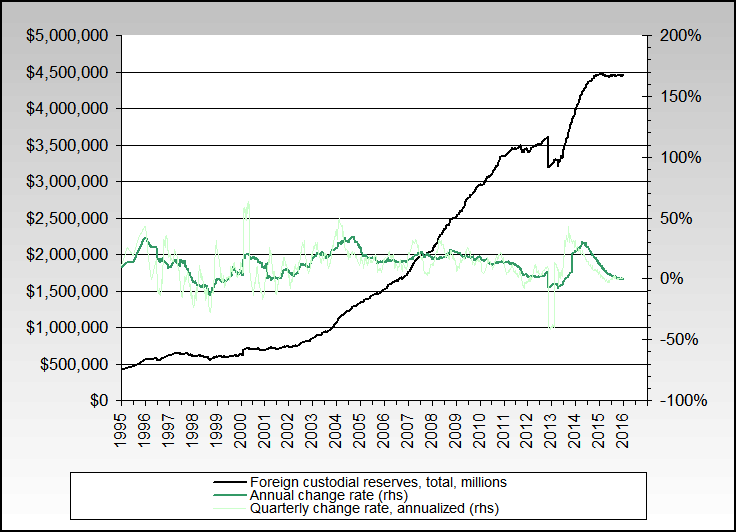

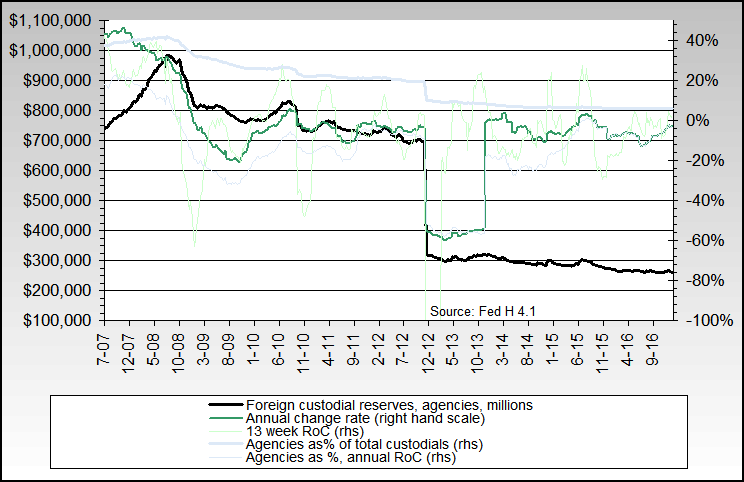

- The U.S. Debt Dashboard

- Dashboard of US Economy

- The UK Debt Dashboard

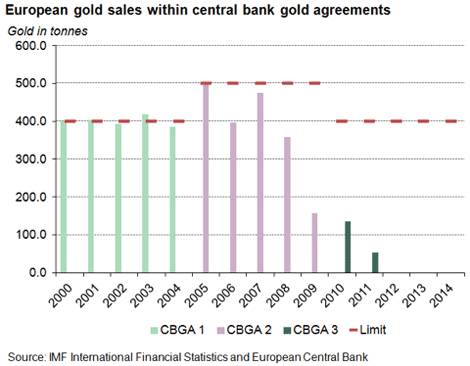

- The Gold Basis