Depuis fin juin et le début de la fable d'un soit-disant amoindrissement de la politique QE par la FED, à laquelle n'ont cru que ceux qui voulaient bien y croire et pas ceux comme nous qui ont gardé une analyse critique indépendante, les commentateurs plus déboussolés que jamais se sont essayés au 'BRICS bashing'. Comme toujours pour ces derniers, il vaut mieux être payé pour avoir tort tous ensemble que raison tout seul. A cette faillite du courage, ce manque de devoir et ce naufrage de la lucidité, nous avons toujours rétorqué non pas par un simple 'mieux vaut être seul que mal accompagné', mais par des analyses qui n'ont pas (elles) que l'apparence de la rationalité et par des propositions politiques innovantes.

Au sujet des BRICS et de leur dynamique irrésistible, le Professeur Toloraya a récemment publié un article très éclairant : "Russia hopes BRICS can create a polycentric world", que j'ai traduit pour l'initiative Euro-BRICS du Laboratoire Européen d'Anticipation Politique. Voici un court passage de "La Russie espère que les BRICS puissent créer un monde multipolaire":

"Voir uniquement les BRICS comme un groupement économique sous-estime non seulement les options que ce partenariat international a à sa disposition, mais aussi le rôle potentiel qu’il aura dans la politique globale du futur."

On peut également trouver éclairant cet extrait de nos indicateurs clés sur la crise systémique globale :

Et la semaine dernière Alexandre Kateb publiait dans Le Monde: "Pourquoi les pays émergents resteront au centre de la croissance mondiale". Le vent tourne dans les rédactions des journaux 'mainstream'.

Nous le répétons, il est grand temps pour la zone Euro de mettre en place une stratégie cohérente de partenariat avec les BRICS, plutôt qu'en rester à la multiplication des relations bilatérales. Les résultats et l'impact en seraient démultipliés. Si ce n'est pas une absence de vision, c'est alors le signe d'une absence de volonté propre qui nuit aux aspirations des peuples européens, et qui met en évidence le déficit démocratique de la construction européenne actuelle. La voie la plus porteuse d'avenir, c'est la stratégie Euro-BRICS.

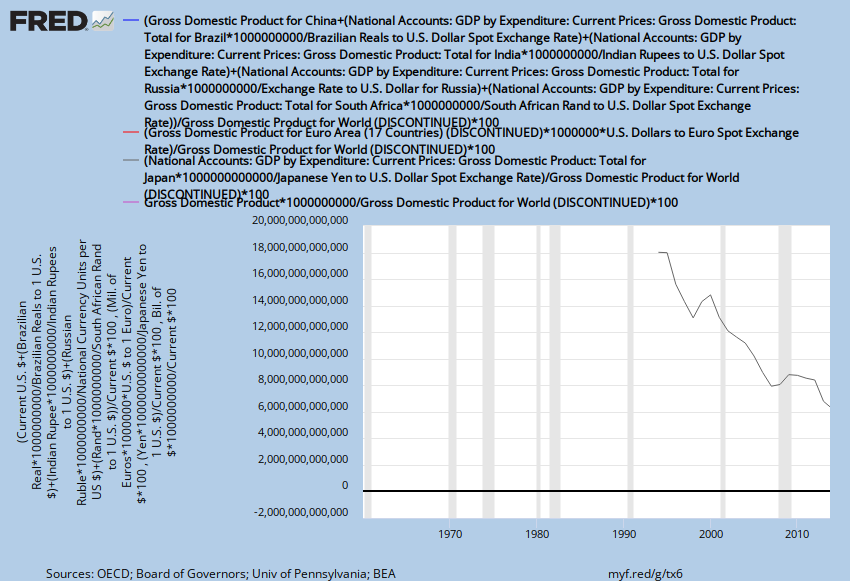

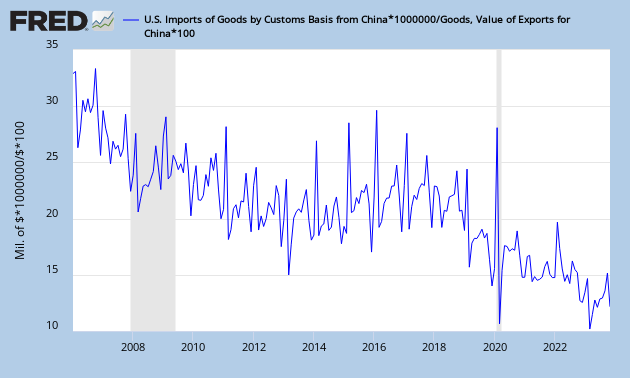

(graphique actuellement généré par la Federal Reserve suite à leur migration technique défectueuse de mars 2014)

Evolution du pourcentage du PNB annuel par rapport au PNB mondial pour les US, l'Eurozone, le Japon, et l'ensemble des BRICS (Brésil, Russie, Inde, Chine, Afrique du Sud)

Nous le répétons, il est grand temps pour la zone Euro de mettre en place une stratégie cohérente de partenariat avec les BRICS, plutôt qu'en rester à la multiplication des relations bilatérales. Les résultats et l'impact en seraient démultipliés. Si ce n'est pas une absence de vision, c'est alors le signe d'une absence de volonté propre qui nuit aux aspirations des peuples européens, et qui met en évidence le déficit démocratique de la construction européenne actuelle. La voie la plus porteuse d'avenir, c'est la stratégie Euro-BRICS.

[ Kateb est l'auteur de l'essai paru en mai 2011 "Les nouvelles puissances mondiales. Pourquoi les BRIC changent le monde". Il peut se lire dans le prolongement du livre de Franck Biancheri "Crise mondiale : en route pour le monde d'après" publié en octobre 2010.]