..: Updated Daily :..

Euro Money Market:

the Unofficial European Systemic Risk Dashboard

(Tableau de bord du risque financier en zone euro)

Note 1 :

During financial crisis, negative short-term yields on government bonds are a sign of fear among investors. Many of them pulled money out of investments seen as risky, pouring cash into the safest securities they could find. Usually, it is short-term government debt, or gold.

This surge in demand pushes up prices. Yields, which move in the opposite direction, tumble sometimes below zero. Since then, negative yields on short-term government debt have happened somewhat regularly, partly reflecting the shrinking supply of investments that investors see as safe even as U.S. stock markets climb. (Source)

Note 2 :

For details on the benchmarks below, read this document and this speech.

Note 3 :

ECB browsed this page which was initiated Q1 2012; ECB releases now every 3 months the official European Systemic Risk Dashboard since 09/2012 :

The refinancing rate is the rate at which the ECB lends money to commercial financial institutions like banks. By changing this interest rate, the ECB can influence the interest rates on the money en capital markets like Euribor and Eonia. Indirectly, by changing the interest rates, the ECB can influence inflation. When the ECB announces an ECB interest rate cut or an ECB interest rate rise, most of the time the refinancing rate is meant.

- see also : Interest rates of 26 Central Banks in the world.

You can observe the peak starting in Dec. 2011 (column A / ECB) both for 7 and 84 days maturities.

Euribor

The Euro Interbank Offered Rate - or EURIBOR - is the average rate for large interbank term deposits offered by European Union member banks to other financial institutions in the EU banking system. EURIBOR rates are also used as a reference rate for forward rate agreements and interest rate swaps denominated in the euro.

The following yield shows the rates at which short-term Euro lending is done on a unsecured basis (non collateralized lending). The panel includes more than 30 banks. Volumes are low.

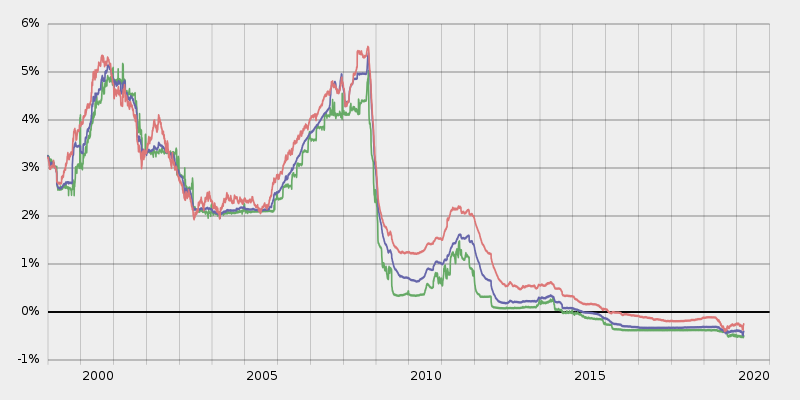

Euribor 3M maturity, 1Y data serie:

Euribor 12m, 3m, 1w maturity rates, data series since 01-01-99 :

12m (red), 3m (blue), 1w (green)

- Others EURIBOR rates and historical charts since 1999.

US$ Euribor and Euro LIBOR

USD Euribor is the rate at which USD interbank term deposits are being offered by one panel bank to another panel bank. It has been discontinued 9/1/2013.

USD Euribor: 1 to 3 weeks maturity rates;

data serie up to 09/01/2013

The Euro Libor overnight rate can be considered as the interbank cost of borrowing funds in Euro :

1Y data serie

Eonia swap is a derivative used to transform overnight interbank lending at the EONIA rate to a fixed rate.

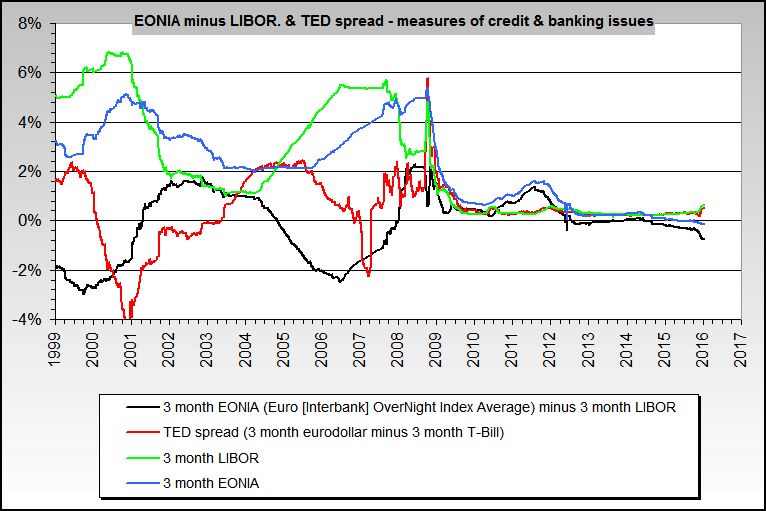

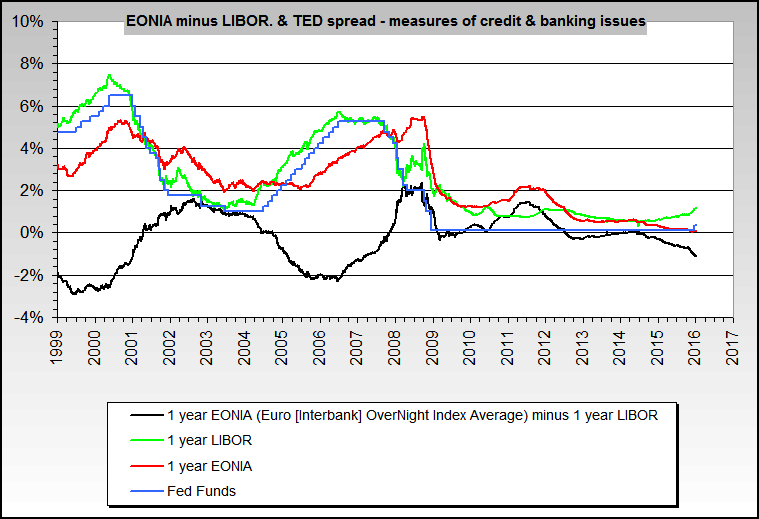

EURIBOR EONIA spread

The Euribor OIS spread is the difference between the euro interbank offered rate and overnight indexed swaps. It measures the eurozone banks’ reluctance to lend to one another.

data serie till 03/2015

Source: ESRB dashboard

Data serie up to 09/05/2013:

This yield curve represents the pan-Eurozone interest rates implied by the most currently used lending transactions. It shows the rates at which short-term Euro lending is done on a secured basis (collateralized lending). The Eurepo curve shows the repo rate for Euro borrowing among European banks at maturities from 1-day to 1-year. We can interpret this inverted curve as a sign that banks are unwilling to commit the collateral (required for the repo) beyond a 1-month contract. (source)

9-Month maturity repo rate first became negative 2012/07/16.

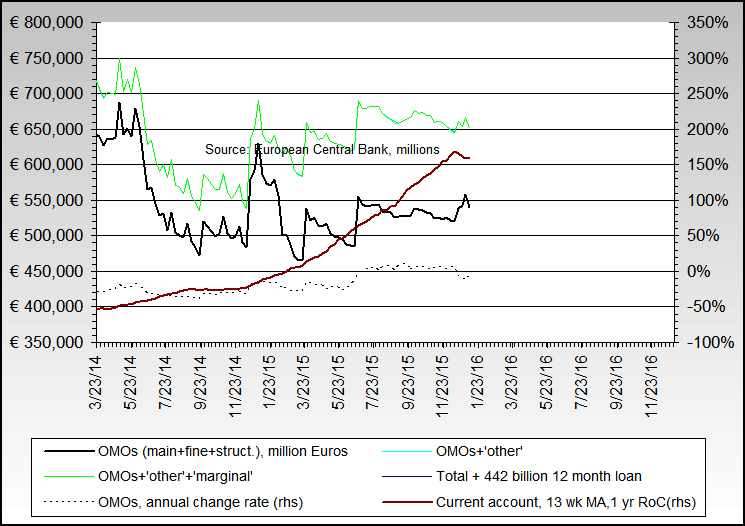

ECB Open Market Operations and Current account

- Read here the main ECB OMO definitions and background page.

- The ECB balance sheet interactive charting tool since 2002

ECB assets; data serie since 1999, updated monthly

ECB Eurozone Liquidity Recourse to the Deposit Facility

2Y Data serie

Source: ESRB dashboard

Nominal effective exchange rate of the Euro (Euro trade weighted index)

- Euro area-18 countries vis-a-vis the EER-20 group of trading partners (AU, CA, DK, HK, JP, NO, SG, KR, SE, CH, GB, US, BG, CZ, LV, LT, HU, PL, RO and CN) :

Data serie since 01/1993; updated daily

- Euro area-18 countries vis-a-vis the EER-39 group of trading partners (AU, CA, DK, HK, JP, NO, SG, KR, SE, CH, GB, US, BG, CZ, LT, HU, PL, RO, CN, DZ, AR, BR, CL, HR, IS, IN, ID, IL, MY, MX, MA, NZ, PH, RU, ZA, TW, TH, TR and VE)

Data serie since 01/1993; updated daily

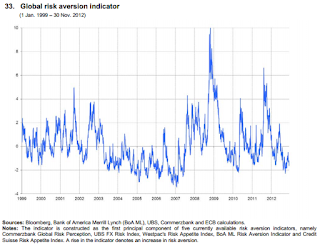

Global risk aversion

Source: ESRB dashboard

- See also this page for others indicators about Euro zone.

Since 5 Sept 2012, ECB Eurozone Liquidity Recourse to the Deposit Facility (ECBLDEPO) page and data are no more available from bloomberg.com

RépondreSupprimerSame for the Euribor OIS spread (.LOISEUR)

RépondreSupprimer